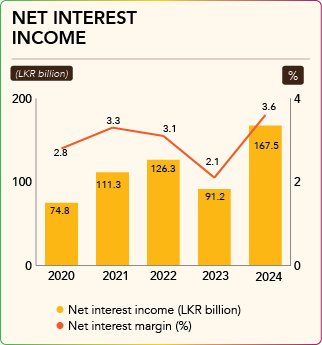

Despite a 14% increase in average interest earning assets, the resulted interest income was LKR 63.7 billion lower than 2023 backed by lower interest rate regime. The interest income from loans and advances which accounted more than 55% of the total interest income dropped to LKR 251.4 billion by 25% compared to last year reflecting effects of shifting to low interest rate scenario.

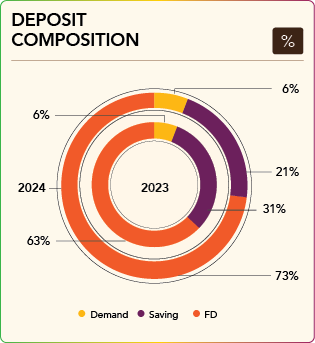

The interest expense declined to LKR 293.6 billion from the level of LKR 433.6 billion reported in 2023. Interest expense which denoted 83% of the interest income in previous year dropped to 64% showcasing the repricing effect of the high cost deposit base. Time deposit cost accounted for about 81% of the total funding cost also came down by 32% during 2024 causing financial cost of fund to come down by about 250 bps during the year. Even though the Bank's CASA ratio experienced a plunge during the year under review, the Bank was able to minimise its negativity steaming to NIM.

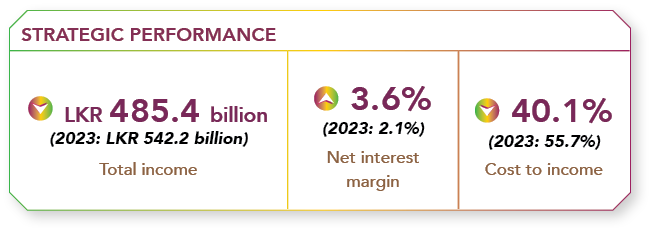

The net interest margin rose to 3.6% during 2024, achieving a five year high, and a noteworthy growth over the 2.1% NIM achieved in 2023.